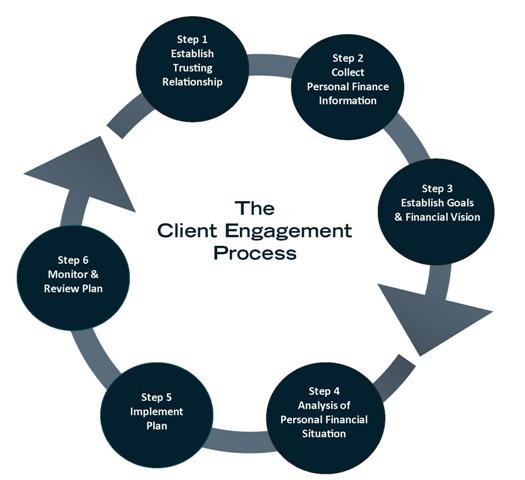

Our Process

Finding the right solution for your personal or business needs requires us to pay special attention to the circumstances of your unique situation. This is why our Financial Services Representatives take a needs-based approach to our insurance sales strategy. Our four-step process of analyzing, recommending, implementing, and reviewing your strategy will help ensure that you get on course to achieving your goals, and remain on course as life unfolds.

-

Analyze. Before we recommend any product or service, we ask questions and get a clear understanding of your financial goals and objectives. We then analyze your insurance portfolio to identify any gaps that may exist in your policies.

-

Recommend. We provide you with suggestions to fill in the gaps so you can choose the products best suited for your situation.

-

Implement. If you're satisfied with our recommendations, we work with you to implement your strategies and secure the required products and services to help ensure your financial freedom.

-

Review. Because your financial situation is bound to change, we work with you over time through periodic reviews to help you monitor the strategies in place, and their capacity to continuously meet your goals.

Our Financial Services Representatives can help you with many of your financial needs. It is important to note that Financial Services Representatives are only able to provide certain services if they are licensed to do so in your state.

Step 1: Initial meeting to get to know each other

Through an initial complimentary consultation, we work together to determine if we might be a good fit for a financial strategies relationship. We give you an overview of our process and capabilities, answering any questions you may have. We spend most of our time seeking to understand your general financial goals, needs and questions. In a nutshell, we want to know where you're at, how you got there, and where you'd like to go. The scope of our collaborative work may be a comprehensive or focused financial strategies, or we may work specifically in the area of investment or risk management strategies; it may involve individual, a couple, family, multi-generational or business planning. If we mutually agree on the scope of a financial strategies relationship, we move to the next step in the process.

Step 2: Gather information to understand your present situation and goals

At this point, we'll seek to obtain as much quantitative and qualitative information as necessary. We'll need to gather various statements and documents. More importantly, we'll specifically identify your financial goals in the areas of education planning, retirement planning, estate planning or other requested areas. Understanding your time frame for various goals and your attitudes toward risk are crucial to developing strategies tailored to your needs, priorities and preferences.

Step 3: Analyze and evaluate your information

We use state-of-the-art technology and a variety of analytical tools to evaluate your financial picture. We perform an asset allocation analysis of your investment portfolios with a review of the various holdings and full review of your various policies. We identify the strengths and weaknesses of your financial situation, and where you stand with respect to your financial goals given your current course of action.

Step 4: Developing your personalized strategy

Based on our analysis, we develop recommendations in the context of selected alternative scenarios and propose strategies and solutions to assist you in reaching your financial goals. We'll collaborate with you to confirm assumptions and get a sense of your thoughts about various strategies along the way.

Step 5: Implementing your financial solutions and strategies

We work with you to determine how to best implement each aspect of your financial strategies. This may involve collaboration with other financial professionals you currently engage (i.e. CPA, attorney) or recommending appropriate financial professionals to you if desired. As a comprehensive financial services firm, we have the ability to use a wide array of providers and solutions to implement your investment, risk management, and estate and business planning strategies.

Step 6: Monitoring your financial strategies on an ongoing basis

We'll continue to monitor the appropriate areas of your financial strategies and your progress over time, in accordance with the scope of our relationship. We'll look to make updates as changes occur in your personal life or in the market overall, taking advantage of new strategies and solutions that may come available over time. As we may change the scope of our relationship or need to make updates over time, we will most certainly revisit the other steps again - as indicated in the circular design at the top of the page.

Financial planning services are offered only through approved Financial Planners of MML Investors Services, LLC.

Financial plan recommendations can be implemented with the advisor of your choosing. Implementation of specific products or services may result in commissions or fees outside of the financial plan fee. Periodic reviews of your financial plan may require a new planning agreement and result in additional fees.